Discovering the Best Prices: A Guide to Working with california mortgage brokers

Discovering the Best Prices: A Guide to Working with california mortgage brokers

Blog Article

Comprehending the Function of Home Loan Brokers in Securing Your Dream Home

Navigating the intricate landscape of home financing can be complicated, but recognizing the essential function of home mortgage brokers provides clarity and support. These professionals function as intermediaries, attaching potential house owners with lending institutions, simplifying the car loan procedure. By examining financial situations and providing tailored recommendations, home loan brokers can open a variety of loan options that may or else continue to be unattainable. Nonetheless, the advantages expand past plain ease. What are the specific benefits of employing a home loan broker, and how can you ensure you choose the best one to protect your dream home? Allow's check out these concerns even more.

What Home Mortgage Brokers Do

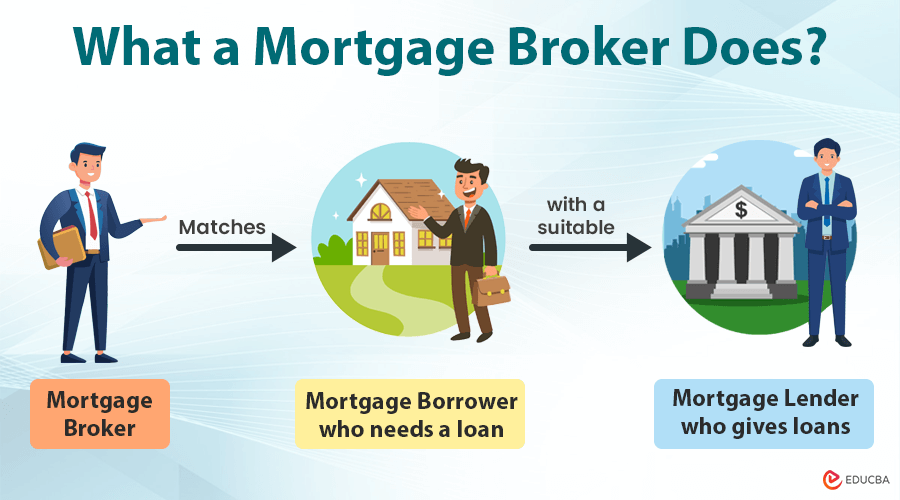

A mortgage broker acts as an intermediary between loan providers and customers, helping prospective homeowners secure financing for their desire residential properties. They play an essential role in the home-buying procedure by leveraging their expertise and industry expertise to attach clients with one of the most suitable mortgage items. Unlike direct lenders, mortgage brokers have accessibility to a vast selection of funding options from various banks, allowing them to tailor options to the particular requirements and economic scenarios of their customers.

Home loan brokers start by examining a debtor's monetary situation, consisting of revenue, credit rating background, and overall monetary health, to determine the best feasible financing alternatives. They after that research and assess different mortgage products, providing a variety of choices that line up with the debtor's goals and restrictions. Throughout this process, brokers provide valuable understandings right into the complexities of home loan terms, rate of interest rates, and car loan structures.

In addition, home mortgage brokers aid with the prep work and submission of lending applications, making certain that all called for documents is precise and full. Their precise interest to information minimizes the possibility of hold-ups or errors that might restrain the approval process. Eventually, mortgage brokers streamline the path to homeownership by simplifying complex financial transactions and using tailored guidance.

Advantages of Employing a Broker

Involving the services of a home loan broker provides countless benefits that can substantially improve the home-buying experience. One of the primary benefits is access to a larger variety of finance products. Home loan brokers have developed relationships with several lenders, enabling them to provide a selection of loan choices customized to fit the one-of-a-kind economic situations of their clients. This breadth of option usually leads to much more competitive rate of interest and terms that could not be available via straight lending institution networks.

Moreover, home loan brokers can conserve prospective house owners beneficial time and initiative. They take care of the elaborate documents, negotiate terms, and simplify the application process, permitting customers to focus on various other aspects of home procurement. Their competence in the mortgage industry additionally converts to seem advice, assisting buyers navigate complex lending criteria and choose the most appropriate funding remedy.

An additional substantial benefit is the tailored solution mortgage brokers provide. They work closely with customers to recognize their monetary goals and constraints, ensuring that the home mortgage lines up with long-term purposes. Furthermore, brokers often have the ability to negotiate far better terms because of their industry expertise and partnerships, even more boosting the worth they bring to the home-buying procedure.

How to Select a Broker

Selecting the ideal mortgage broker is a crucial action in protecting your desire home. The process starts with research; gathering details regarding possible brokers is vital. Look for brokers with a tested track document and strong track record in the industry. Recommendations from friends, household, or actual estate professionals can be indispensable. Furthermore, on the internet evaluations and endorsements can give insight right into a broker's integrity and performance.

Guarantee they are licensed and signed up with appropriate regulatory bodies. An effective broker must be able to clarify complex financial terms plainly and be receptive to your inquiries.

During first appointments, examine go to my site their understanding of your requirements. A proficient broker will make inquiries concerning your financial circumstance, objectives, and choices to customize their solutions to you. In addition, compare their fee frameworks to avoid unanticipated expenses. Transparency concerning charges and compensations is a characteristic of expertise. Ultimately, trust your instincts; a broker who influences confidence and shows integrity will be a valuable partner in your home-buying journey.

Lending Alternatives Readily Available

When getting started on the journey to acquire your dream home, recognizing the range of loan alternatives available is crucial. The mortgage landscape uses a selection of products, each catering to different monetary scenarios and choices. Standard lendings, commonly preferred for their affordable passion prices, are suitable for borrowers with strong credit report and a substantial deposit. These finances are not insured by the federal government, unlike FHA lendings, which are developed for those with reduced credit report and marginal down settlements, making homeownership extra obtainable. california mortgage brokers.

VA car loans, exclusive to experts and active armed forces members, supply positive this link terms, including no down repayment and no personal home loan insurance (PMI), standing for a considerable benefit for qualified individuals. USDA finances provide to suv and country buyers, supplying zero down repayment alternatives for those meeting particular earnings requirements. For those looking for flexibility, adjustable-rate home loans (ARMs) include lower initial rate of interest prices that change with time, lining up with market conditions.

Jumbo lendings are tailored for high-value residential property acquisitions exceeding conventional loan restrictions, demanding stronger financial qualifications. Reverse home loans, available to seniors, permit taking advantage of home equity without regular monthly settlements. Each option provides special benefits and factors to consider, enabling borrowers to align their go option with financial goals and conditions.

Tips for Collaborating With Brokers

Navigating the procedure of purchasing a home can be frustrating, and functioning with an experienced mortgage broker can be a very useful property in enhancing this journey. Begin by plainly specifying your monetary goals and restrictions, so your broker can tailor their search for suitable mortgage products.

Conduct complete research study to ensure you are dealing with a respectable broker. Validate their qualifications, checked out reviews, and seek referrals from relied on resources. This persistance guarantees you are collaborating with a specialist that has a tested performance history of success.

Communication is vital; keep regular get in touch with and immediately react to demands for documentation or info. This joint effort will accelerate the procedure and enable the broker to act swiftly in your place.

Final Thought

The role of mortgage brokers is essential in navigating the complexities of home funding. Choosing a certified broker and successfully collaborating with them can considerably improve the home getting experience, guaranteeing a smoother path to protecting the suitable mortgage.

By evaluating financial circumstances and supplying tailored guidance, home loan brokers can open a plethora of funding alternatives that may otherwise stay hard to reach. Unlike straight loan providers, mortgage brokers have access to a broad variety of car loan alternatives from numerous economic institutions, enabling them to customize selections to the specific demands and financial scenarios of their clients.

Home loan brokers have developed partnerships with numerous lenders, enabling them to present a range of financing options tailored to fit the distinct monetary circumstances of their clients.

Report this page